HR Services- Compliance Plan Documents:

Section 125 Cafeteria Plan: is an employer-sponsored benefits plan that lets employees pay for certain qualified medical expenses – such as health insurance premiums – on a pre-tax basis. … Contributions to the cafeteria plan are made before taxes are taken out of their paychecks.

Section 125 Plan Documents – The IRS requires a Section 125 Plan Document so that employees can pay for health premiums, FSA contributions, and other group benefits with tax-free payroll deductions. Employers save 7.65% in FICA payroll taxes for every dollar an employee has deducted as part of a section 125 plan.

Summary Plan Descriptions (SPDs) – A key compliance document that informs participants and beneficiaries about their rights and benefits under the employee benefit plans in which they participate. ERISA requires every employee benefits plan to have a summary plan description that must be automatically distributed to all plan participants within 90 days after an employee first becomes covered under the plan. The SPD must be written and include specific information about the plan such as the plan’s eligibility rules. If the plan administrator, the Employer group, fail to provide the SPD within 30 days to the participant, the DOL may impose a civil penalty of up to $159 per day for each day the failure continues up to a maximum penalty of $1594 per request. Optima will assist you with determining what information must be included, when the SPD must be provided to plan participants and how the SPD may be distributed.

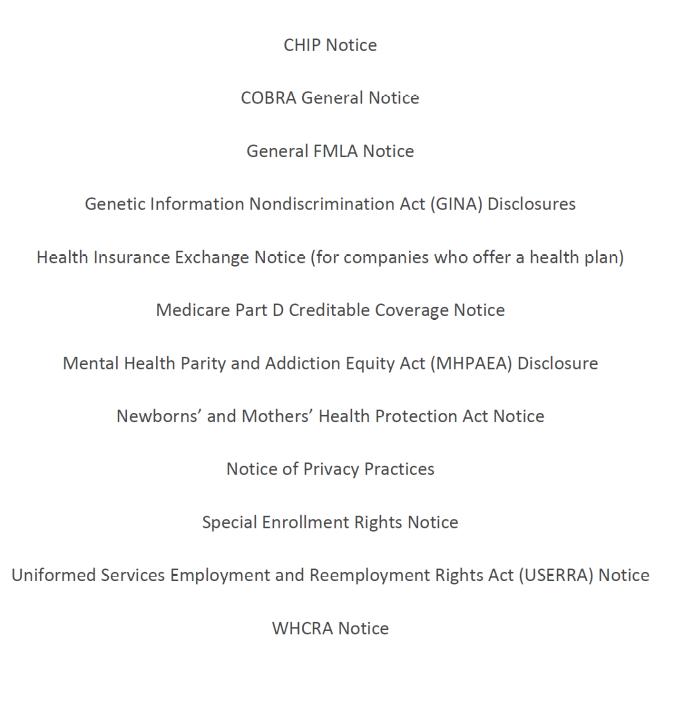

Compliance Notice Builder- We have the tools to provide you with full compliance on your benefits plan and will provide you with the following required notices.